µ5/ Platform Economics at Scale

Think platforms are just about adding users? What if they can multiply value?

Think platforms are just about adding users? What if they can multiply value?

This edition shows how to:

• Multiply Value: Amplify impact with every addition.

• Scale Smarter: Cut costs as usage grows.

• Expand Markets: Unlock new opportunities.

And, includes:

• A fintech case study on tripling users while reducing costs.

• A Platform Value Calculator to assess growth potential.

Ready to multiply? Let’s dive in.

Warm regards,

Adi

5/ TURN TECHNOLOGY PLATFORMS INTO VALUE MULTIPLICATION ENGINES

In 2009, Netflix made what seemed like a counterintuitive decision.

Instead of keeping their streaming platform tightly controlled, they began aggressively expanding it to gaming consoles, smart TVs, and mobile devices. While competitors focused on protecting their technology, Netflix focused on multiplication.

By 2011, their platform strategy had transformed them from a DVD-by-mail company into a global streaming powerhouse.

The lesson wasn't about the technology - it was about understanding platform economics.

Netflix grasped early what many technology leaders are discovering today: the value of a platform isn't in its size or capabilities but in its ability to multiply impact across an ecosystem.

Today we learn a framework for turning traditional platforms into exponential value engines.

SCALE PLATFORM VALUE

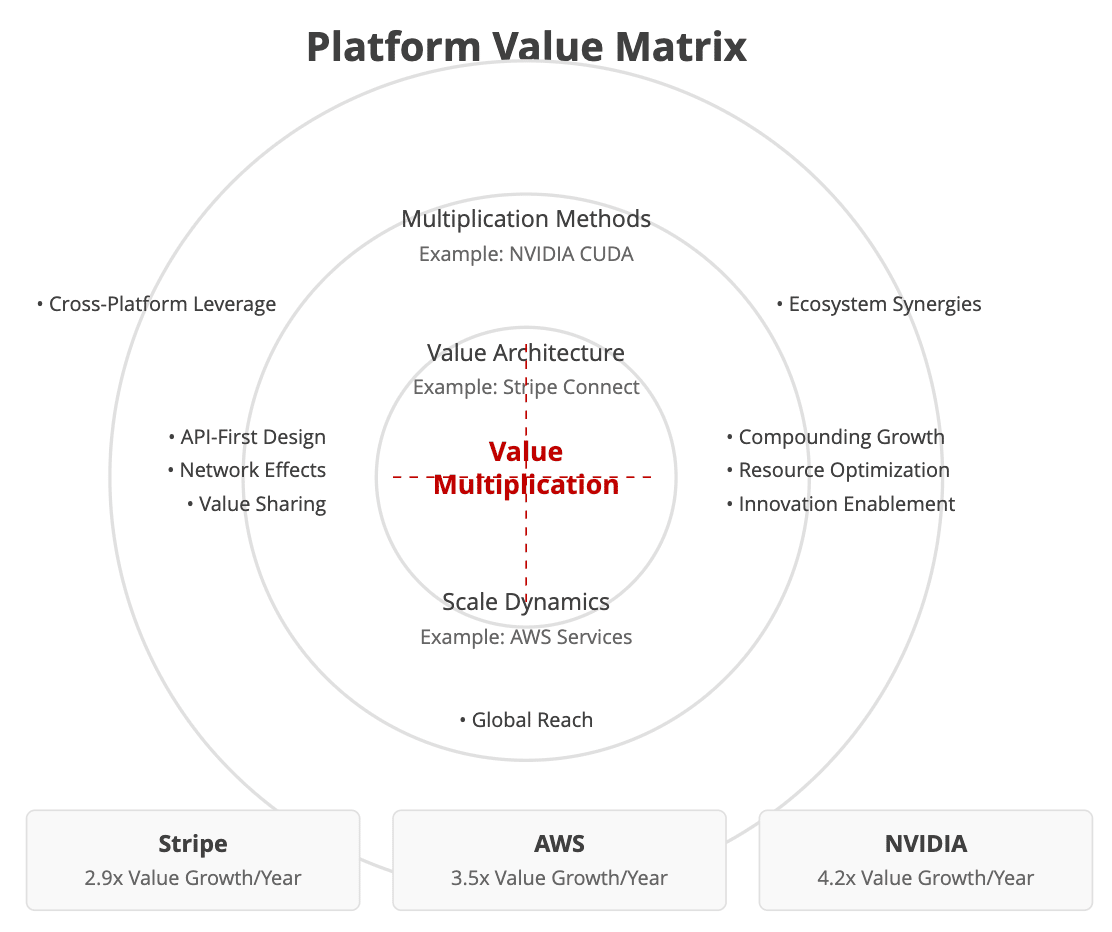

The Challenge: Most platform strategies focus on linear growth - more users, more features, more capacity. But the most successful platforms in the world - think AWS, Nvidia's CUDA, or Apple's App Store - don't just grow. They multiply the value with every new addition to their ecosystem.

The challenge isn't technical; it's architectural.

THE FRAMEWORK: PLATFORM MULTIPLICATION MODEL

1. Value Architecture

Why:

Traditional platforms focus on linear growth through feature addition. Value architecture reimagines your platform as a multiplicative engine where each component amplifies the value of others.

How:

Design for Network Effects: Build features that automatically increase value for all users when new users join. For example, Slack becomes more valuable to everyone when new users and teams join the network.

API-First Economics: Make every feature an integration point that external parties can build upon. Your platform becomes more valuable through others' innovations.

Ecosystem Amplification: Create tools, documentation, and incentives that make it easy for partners to extend your platform's capabilities.

Expected Outcomes:

3-5x increase in per-user value

60%+ reduction in feature development costs

Exponential growth in use cases without direct investment

Example:

Stripe's Connect feature exemplifies this approach. By designing their platform architecture around extensibility, they enabled thousands of marketplaces to build on their infrastructure. One feature multiplied into thousands of revenue streams, with companies like Shopify, Lyft, and DoorDash building entire business models on top of it.

2. Scale Dynamics

Why:

Most platforms hit growth ceilings because their costs scale linearly with usage. True platform economics require breaking this linear relationship.

How:

Compounding Capabilities: Design features that increase in value exponentially with usage. Each new user should make the platform smarter or more capable.

Resource Optimization: Build infrastructure that becomes more efficient at scale through shared resources and learned optimizations.

Innovation Acceleration: Create tools and frameworks that speed up development for everyone building on your platform.

Expected Outcomes:

Sub-linear cost scaling (40-60% cost reduction at each scale milestone)

2-3x faster feature deployment

5x increase in third-party innovation

Example:

AWS revolutionized scaling economics. Their auto-scaling and serverless technologies mean customers pay only for what they use, while AWS's costs per customer decrease with scale. Their development tools like Lambda and Amplify accelerate innovation across their ecosystem.

3. Multiplication Methods

Why:

The most valuable platforms don't just scale - they multiply value across domains and use cases, creating new markets and opportunities.

How:

Cross-Platform Leverage: Design capabilities that can be instantly deployed across different platforms, markets, and use cases.

Ecosystem Synergies: Build mechanisms for value-sharing that incentivize ecosystem growth and collaboration.

Global Reach: Create platform architecture that enables seamless global deployment while respecting local requirements.

Expected Outcomes:

10x increase in addressable market size

70%+ reduction in time-to-market for new verticals

4-5x growth in platform revenue through ecosystem expansion

Example:

NVIDIA's transformation showcases the power of multiplication methods. Their CUDA platform, initially designed for gaming graphics, became the foundation for AI and machine learning. By making their GPU capabilities universally accessible, they multiplied their market opportunity many times over. Today, NVIDIA powers everything from autonomous vehicles to medical research, all from the same core technology base.

Platform success isn't just about what you build - it's about how you architect for multiplication.

CASE SNAPSHOT

In 2021, a global financial services provider faced a common platform challenge. Their trading platform served 50,000 users but required massive resources to maintain and scale. Each new feature or customer meant nearly linear increases in cost and complexity.

The transformation began not with technology, but with thinking differently about value creation. Instead of building everything themselves, they created a marketplace where fintech partners could offer services through their platform. They implemented usage-based pricing and revenue sharing.

Results after 18 months:

User base grew 3x; Infrastructure costs grew only 40%

Partner ecosystem expanded 5 -> 75 companies

New feature deployment time dropped from months to days

Platform revenue grew 4x from ecosystem monetization

Key insight: Stopped trying to be the sole provider of value and instead became an enabler of value creation.

LEADER’S TOOLKIT

This Week's Action: Platform Value Calculator

Most platform assessments focus on technical metrics, missing the true drivers of value multiplication. This calculator helps you identify where your platform can create exponential rather than linear growth.

In just 15 minutes, evaluate your platform’s potential across four critical value-generating dimensions.

Steps:

Gather basic metrics around user growth, API usage, and feature adoption

Score each dimension honestly - this is about improvement, not validation

Calculate your platform value score and review the specific recommendations

Share results with your leadership team to align on priority improvements

Interpret Your Results:

Score: Below 40 - Foundation Building

Your platform prioritizes stability over multiplication

Focus first on API development and basic partner enablement

Expected Outcome: 6 months to basic multiplication capability

Score: 40-70 - Value Acceleration -

Good technical foundation exists

Prioritize ecosystem growth and network effects

Expected Outcome: 2-3x value growth within 12 months

Score: Above 70 - Multiplication Phase

Strong platform economics in place

Focus on expanding into adjacent markets

Expected Outcome: 5-10x value potential in 18-24 months

Be Aware: Your platform’s potential for value multiplication often exists in unexpected places. Use this calculator quarterly to track progress and identify new opportunities for exponential growth.

Tool Access: Platform Value Calculator

IN CLOSING

Remember: Platform thinking isn't about how much you can build - it's about how much you can enable others to build. Start small: identify one capability in your platform that could create value for an entire ecosystem, not just your direct users.

That's your multiplication starting point!

TOOLS IN THIS EDITION